Published on April 17, 2024 at 4:53:40 AM

What may be the impact of escalation of conflict in Middle East on Indian stock markets?

Conflict in Middle East has escalated. On the night of 13th April, 2024, Saturday, Iran launched some 300 drone attacks on Israel. This was done in retaliation to Israel’s attack on Iran’s consulate in Damascus. Israel has said that it was able to successfully intercept and shot down 99% of the 300 drones. Damages were extremely limited. Nevatim air base in south of Israel suffered minor damage. A girl, 7 years old, also died.

The risk of an Israeli retaliation to maintain its deterrence

The risk now is Israel retaliating to the attack. Israel may have to do this to maintain its deterrence. By attacking it, Iran has breached its deterrence. Deterrence means a country attacking an adversary simply to discourage it and others from future attacks. The probability of such a retaliation cannot be completely ruled out.

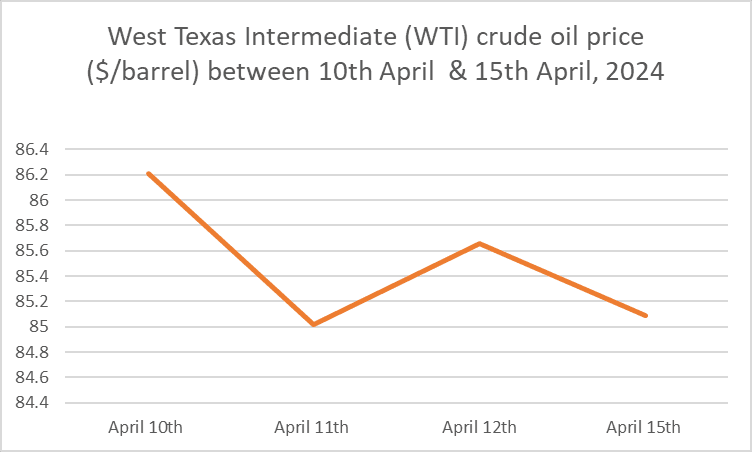

Both stock markets and oil markets are currently more inclined towards the probability that Israel will not resort to such a retaliation, at least in the near term. Benny Gantz is the main political opponent of Israeli Prime Minister, Benyamin Netanyahu. He is a key member of Israel’s war cabinet. He has said that Israel can wait before launching such a retaliation. He asserted that Israel should launch such an attack only when the time is right. A prevailing view in the markets is that because Israel’s defense forces are already exhausted due to 6 months of war in Gaza, Israel may stay away from immediate retaliation. US is also putting pressure on Israel to not go for any such retaliation. The above expectations explain why oil prices have not shot up in the past 2 days, after the Iran attacks.

Source: cmegroup.com

Impact on Indian stock markets

An escalation in the conflict due to Israel’s retaliation will adversely impact a number of Indian stocks. Oil prices will definitely shoot up. This will put upward pressure on inflation. This will in general be bad for the Indian economy. RBI may use this as a reason to postpone interest rate cuts further. Stocks of oil marketing companies such as Indian Oil etc. will definitely be adversely impacted with increase in oil prices. On the other hand, stocks of oil & gas production companies such as ONGC will benefit from the rise. Oil refiners, such as Reliance Industries, use crude oil as their input. Rise in crude oil prices will hurt them and their stocks if they are unable to pass on the increase, fully, to their customers.

India’s exports to Europe and Middle East will be adversely impacted. Freight costs may go up further. Already, air freights costs are up after Houthi rebels of Yemen started attacking cargo ships in Red Sea. Due to the risks in Red Ship, more goods from India are getting exported through the air route. Rise in freight costs will push up the overall costs of Indian exports. This in turn may make them less competitive. Stocks of companies in export-oriented sectors may therefore get adversely impacted in the foreseeable future, if the conflict escalates. For the same reasons, the price of India’s imports may also go up. This may increase the cost of inputs for a number of companies that use imported goods as components. This may again push up inflation. It may also have an adverse impact on the profit margins of companies.

USA has said that it will not be part of any retaliation against Iran by Israel. If USA, in spite of this assertion, gets pulled into the conflict then it will have a much wider impact on the global economy, including that of India. This in turn may have an impact on much wider set of India stocks, from across sectors.

Impact on commodity prices and stocks of commodity companies

The conflict is likely to have significant impact on commodity prices. Gold is already at all time highs. Its demand has gone up because of its safe haven status. In times of conflicts such as wars, investors buy more gold. Prices of some other metals have also gone up after new sanctions by US and UK on metals produced in Russia. Any further shock because of escalation in conflict between Israel and Iran may roil commodity markets. Indian commodity stocks should be watched out for.

Foreign Portfolio Investors may become more risk averse

A conflict between Israel and Iran will make foreign institutional investors (FIIs or FPIs) more risk averse. This may see selling by them in Indian stock markets. This selling pressure may put significant downward pressure on Indian stock markets. On Friday, 12th April, 2024, FIIs were net sellers of Rs 8,027 crore in Indian stock markets.

High valuations at which stock markets are trading

On 15th April, 2024, Nifty 50 closed, down by 246 points or 1.10%. Sensex closed, down by 845 points or 1.14%. Japanese Nikkei ended the day, down by 290.75 points. Stock prices in major countries, including India, are already at high valuations. Average P/E ratio at which stocks at NSE are currently trading is around 31. 84. This high valuation means that if tensions escalate the decline in Indian stocks’ prices may also be much sharper.

Buying opportunity too !

Any such declines due to escalation of conflict may also be a buying opportunity for investors with long term investment horizon. They can buy good blue-chip stocks or stocks with high growth potential, at lower prices.

Indian economy has performed relatively well in the past one year, when compared to many other economies. There is therefore good reason that Indian stock markets may be less adversely impacted when compared to many other stock markets because of this escalation.

Invest wise with Expert advice

Karvy Customer: For activating your account click here

Latest Articles

Join us & get started