Published on April 26, 2024 at 2:31:03 PM

The Path Ahead for Dollar

US dollar has strengthened against major currencies in the past few months. According to data from The Economist, in 2024 till date, the US dollar has appreciated by an average of 4% against the currencies of its major trading partners. The Japanese Yen is trading at its lowest level in more than 3 decades against the dollar. In the past 1 year, dollar has appreciated by more than 1.7% against the Indian rupee.

A strong US economy is causing appreciation in dollar

One reason for this appreciation of dollar is that American economy remains strong when compared to other economies. It seems that the decision of many US States to not go for lockdowns during the Covid years has given an edge to the US economy against economies of other countries. In the December quarter of 2023 , US GDP grew y-o-y by 3.4%. In the same quarter, Germany’s GDP contracted by – 0.2%. In the September quarter Germany’s economy had contracted by -0.3%. UK’s GDP growth in 2023 stood at a measly 0.1%. Unemployment rate in India in March stood at 7.6%; in US it stood at 3.8%. Some are going to the extent of saying that American economy is booming currently when compared to those of other countries.

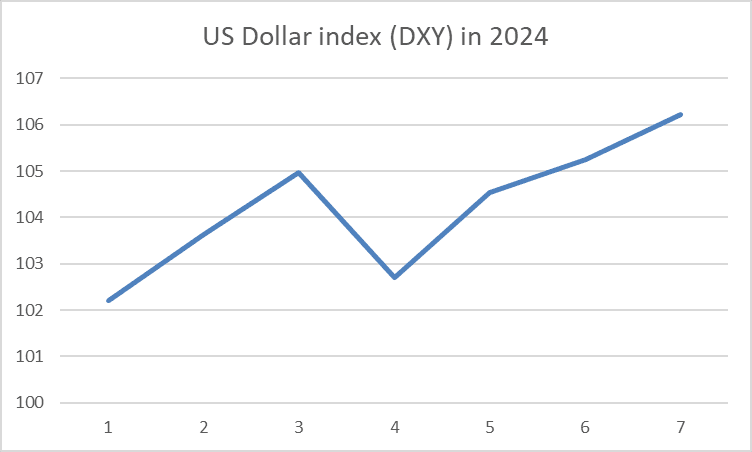

Source of Data: ICE

Postponement of interest rate cut by US Federal Reserve

The higher interest rate that is being kept by US Federal Reserve has also contributed to the appreciation of US dollar. When interest rate in a country rises in comparison to that of another country, its currency tends to appreciate against the currency of the other country. Many central banks, such as RBI in India, have kept pace with rise in interest rates in US. They increased interest rates in their own countries, so that dollar does not strengthen further against their own currencies.

The US Federal Reserve has indicated that it is unlikely that it will go for an interest rate cut before September 2024. This means that dollar is likely to remain strong against other currencies in the near term.

Increase in global uncertainty

Dollar is also considered to be a safe haven asset. If global uncertainty exacerbates then too dollar will appreciate further. Worsening of conflicts in Middle East or Ukraine will increase global uncertainty. Investors will then pull more of their money from other countries and invest in dollar assets. Indian markets saw significant pulling of money from foreign portfolio investors, when uncertainty increased due to Iran’s drone attack on Israel. US dollar index rose sharply after 10th April, when situation in Middle East worsened.

AI boom also contributing to strengthening of dollar

The Artificial Intelligence (AI) boom has also contributed to the strengthening of US dollar. AI is expected to bring a kind of revolution in future. Much of the AI development is taking place in US technology companies. Nvidia, a major maker of chips for AI is an American company. Microsoft is at the head of the AI thing with its billion dollar investment in Open AI, the owner of ChatGPT. Google, another major player in AI space, is an American company. Global investors are putting more of their money in American technology stocks after pulling them from stock markets of other countries. This has increased demand for dollar against other currencies.

The Indian Summer!

A stronger dollar makes India’s exports cheaper in dollar terms. Exporters such as those of IT services may see their revenues and profits going up in rupee because of dollar appreciation. But India’s imports also become more expensive because of a stronger dollar. For much of its imports, India pays in US dollars. Similarly, Indians opting for foreign travel are now paying more. Parents whose children are studying in American universities are having to shell out more because of dollar’s continued appreciation against rupee. Indian companies that use imported components in their products are seeing their cost of production go up. India is dependent on imports for 80% of its oil needs. An appreciation in dollar has increased the amount that India pays in rupee terms for its oil imports. This means that Indians are having to pay more for oil products such as petrol.

If RBI or any other central banks cuts interest rates before US Federal Reserve starts doing so, then the risk is high that their currencies will depreciate further against the dollar. Foreign investors will further pull out money from assets denominated in currencies such as rupee and invest them in dollar denominated assets. This, because of the relative increase in yields in dollar assets due to cutting down of interests in other countries.

The path ahead still looks to be in favor of dollar!

Invest wise with Expert advice

Karvy Customer: For activating your account click here

Latest Articles

Join us & get started